Types of Bank Accounts Explained

Bank accounts are tools that help you manage, save, and grow your money. Whether you're handling daily expenses, saving for future goals, or running a business, choosing the right type of account is key. Here's a quick breakdown:

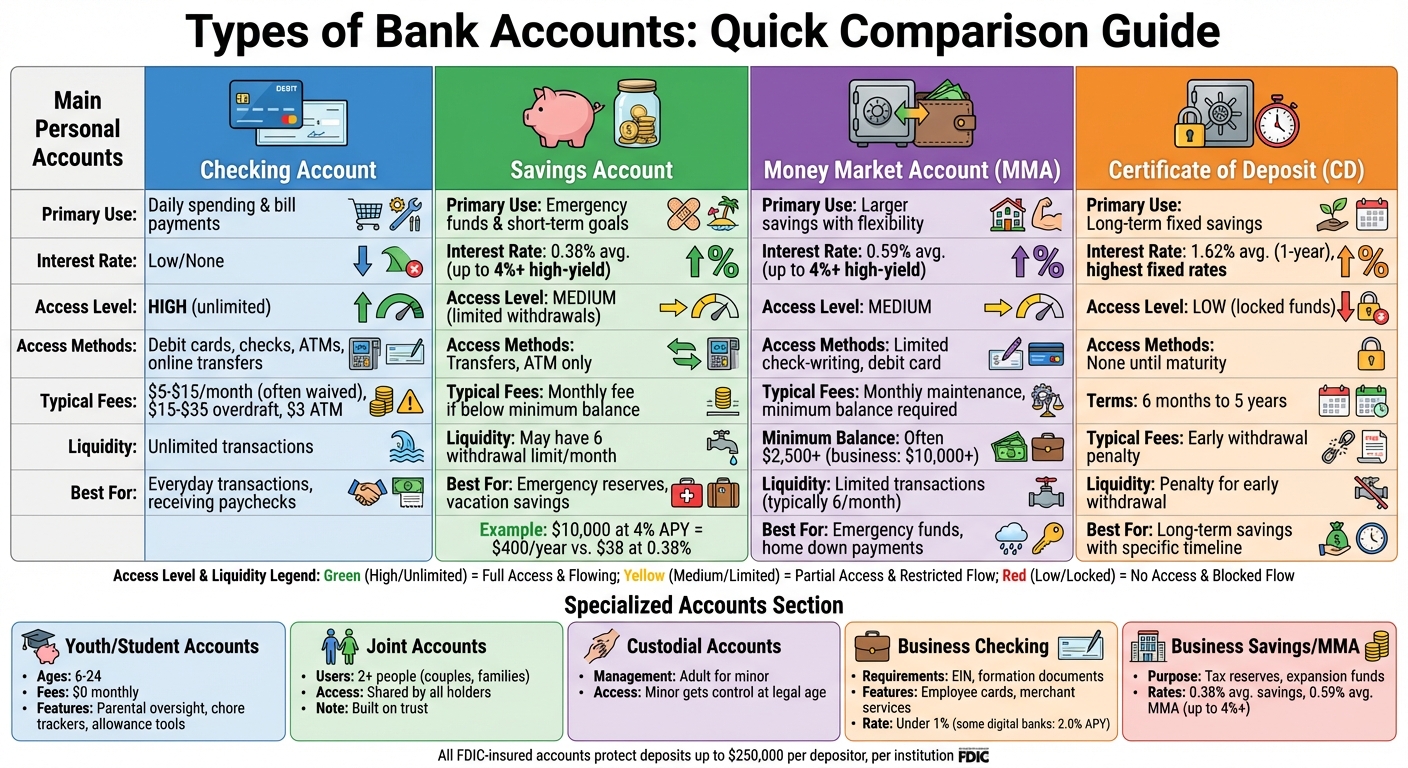

- Checking Accounts: Perfect for everyday spending and bill payments. They offer unlimited access via debit cards, checks, and online transfers but usually earn little to no interest.

- Savings Accounts: Designed for saving money while earning interest. Ideal for emergency funds or short-term goals, though withdrawals may be limited.

- Money Market Accounts (MMAs): Combine savings and checking features, offering higher interest rates but requiring larger balances. They allow limited check-writing and debit card use.

- Certificates of Deposit (CDs): Lock your money for a fixed term in exchange for higher, fixed interest rates. Early withdrawals often incur penalties.

For specialized needs:

- Youth and Student Accounts: Teach financial skills with no fees and parental oversight.

- Joint Accounts: Shared access for couples or families.

- Custodial Accounts: Managed by an adult for a minor until they reach legal age.

- Business Accounts: Separate personal and business finances, offering tools like employee debit cards and tax management features.

Quick Tip: Match your account choice to your financial goals. Checking accounts are great for daily use, savings accounts for short-term reserves, and CDs for long-term growth. Business accounts help streamline operations and protect personal assets.

| Account Type | Best For | Interest Rates | Access Level |

|---|---|---|---|

| Checking | Daily spending | Low/None | High (debit, checks) |

| Savings | Emergency funds, short-term | Moderate | Medium (limited access) |

| Money Market (MMA) | Larger savings, flexibility | Higher | Medium (limited checks) |

| CDs | Long-term fixed savings | Highest (fixed) | Low (locked funds) |

Understanding your options helps you manage your money effectively and achieve your financial goals.

Bank Account Types Comparison: Features, Rates, and Best Uses

Types of bank accounts | Banking | Financial Literacy | Khan Academy

Main Personal Bank Account Types

Here’s a closer look at the main types of personal bank accounts and how they serve different financial needs.

Checking Accounts

A checking account is your go-to for everyday transactions. As Investopedia puts it:

"Your checking account serves as the main gateway for all of your cash, making it an essential part of your financial toolbox."

With a checking account, you can pay for groceries, settle your rent, or cover bills using debit cards, checks, ATMs, electronic transfers, and apps like Zelle. Unlike savings accounts, checking accounts don’t limit how often you can access your funds, making them perfect for managing daily expenses.

There are several types of checking accounts tailored to specific needs:

- Standard Checking: Often comes with no monthly fees or minimum balance requirements.

- Interest-Bearing Checking: Pays interest on your balance but may require you to meet certain conditions.

- Student Checking: Geared toward individuals aged 17 to 24, often with waived fees.

- Second-Chance Checking: Designed for those looking to rebuild their banking history.

However, keep an eye on fees. Monthly maintenance fees can range from $5 to $15, though many banks waive them with direct deposits or minimum balances. Out-of-network ATM withdrawals might cost around $3, and overdraft fees typically fall between $15 and $35.

If you’re looking to save rather than spend, a savings account might be a better fit.

Savings Accounts

Savings accounts are ideal for setting aside money for specific goals while earning interest. These accounts are designed to encourage saving by limiting withdrawals - many banks still cap certain types of withdrawals at six per month.

A major perk of savings accounts is compound interest. For example, depositing $10,000 in a high-yield account with a 4% APY could earn nearly $400 annually, compared to just $38 at the national average rate of 0.38% (as of June 2025). High-yield savings accounts often exceed 4% APY, making them a popular choice for savers.

Many people use savings accounts as "buckets" to organize funds for goals like emergency reserves, vacations, or down payments. You can also link your savings account to your checking account for overdraft protection, automatically transferring funds when needed.

For a mix of saving and spending flexibility, money market accounts are worth considering.

Money Market Accounts

Money market accounts combine features of savings and checking accounts. They often offer higher interest rates than standard savings accounts - averaging 0.59% nationally in June 2025, with some high-yield options exceeding 4%. These accounts also allow limited check-writing and debit card use, offering more flexibility.

That said, money market accounts typically require a higher initial deposit, often around $2,500, and use tiered interest rates, meaning larger balances earn higher yields. They also enforce transaction limits, usually capping certain transfers at six per month. These accounts are a good option for emergency funds or other savings goals, provided you can meet the minimum balance requirements.

For those seeking fixed returns over a set period, certificates of deposit (CDs) are another option.

Certificates of Deposit (CDs)

CDs are savings tools that lock your funds for a specified term in exchange for a fixed interest rate. Terms usually range from six months to five years, and as of June 2025, the average one-year CD offered a 1.62% return. Generally, longer terms come with higher interest rates.

The trade-off for the higher returns is reduced liquidity. Withdrawing funds before the CD matures often results in penalties, which can eat into your principal. This makes CDs a good choice for money you won’t need right away, like funds set aside for a future home purchase or tuition.

Some variations, like no-penalty CDs, allow early withdrawals without fees but typically offer lower rates. Step-rate CDs, on the other hand, increase their interest rates at predetermined intervals during the term. Regardless of the type, CDs are insured by the FDIC or NCUA for up to $250,000 per depositor, per institution.

Here’s a quick comparison of these account types:

| Feature | Checking | Savings | Money Market | CD |

|---|---|---|---|---|

| Primary Use | Daily spending | Short-term goals | Hybrid saving/spending | Long-term fixed saving |

| Interest Rate | Low or none | 0.38% avg. | 0.59% avg. | 1.62% avg. (1-year) |

| Check Writing | Yes | No | Yes (limited) | No |

| Debit/ATM Card | Yes | ATM only | Yes | No |

| Liquidity | Unlimited | May have limits | Limited transactions | Penalty for early withdrawal |

Specialized Personal Accounts

Specialized accounts are tailored to different life stages, making money management easier for young individuals and families.

Youth and Student Accounts

Youth and student accounts are crafted for individuals aged 6 to 24, with a focus on teaching financial skills rather than just facilitating transactions. Many of these accounts come with $0 monthly fees. For instance, Chase First Banking is available for children as young as 6 and charges no monthly fees.

Youth accounts are typically overseen by a parent or guardian, who can set spending limits and receive alerts. These accounts often include unique features like chore trackers, allowance tools, and savings goal options - features not commonly found in standard accounts.

Student accounts, aimed at those aged 17–24 enrolled in high school, college, or vocational programs, provide more independence by waiving fees. However, these accounts often transition to standard accounts with higher fees once the user surpasses a certain age . Interestingly, research from the CFPB highlights that some college-endorsed accounts may charge higher fees than anticipated. It’s always wise to carefully review and compare account requirements.

Joint and Custodial Accounts

For those seeking shared financial solutions, joint and custodial accounts offer distinct benefits.

Joint accounts allow two or more individuals - such as spouses, partners, or parents and children - to access the same funds. Each account holder can deposit, withdraw, or make purchases independently. While this setup is ideal for managing shared expenses, it requires complete trust. As Bank of America emphasizes:

"A joint banking account is built on trust".

However, it’s important to note that any co-owner can withdraw all the funds, and creditors may claim the account’s balance to settle one owner’s debts.

Custodial accounts, on the other hand, operate differently. These accounts are managed by an adult on behalf of a minor, often described by Investopedia as:

"training-wheels" accounts, where an adult manages funds specifically for a minor's benefit.

The minor typically gains access to the funds after reaching the age of majority. Custodial accounts are particularly useful for handling inheritances or gifts under legal frameworks like the Uniform Transfers to Minors Act. While joint accounts emphasize shared access and transparency, custodial accounts focus on responsible management until the child is old enough to take over.

These specialized accounts can play a key role in your financial plan, aligning with your current stage of life and financial goals.

sbb-itb-4f1eab7

Business Bank Account Types

When it comes to business banking, the requirements and features differ significantly from personal accounts. Unlike personal accounts, which typically need just a Social Security number and personal ID, business accounts require an Employer Identification Number (EIN) and formation documents. This distinction is crucial for protecting personal liability and simplifying tax processes. As Dan Casarella from the U.S. Chamber of Commerce explains:

"A business checking account is critical for entrepreneurs to separate their personal finances from their business ones".

Business Checking Accounts

Business checking accounts are designed to handle daily operations like paying vendors, ordering supplies, and processing payroll. These accounts often come with specialized tools such as employee debit cards and "Shared Access", allowing specific tasks to be delegated without granting full account control. For example, in late 2025, Chase introduced business checking accounts integrated with merchant services, streamlining card payment processing and expense tracking.

However, these accounts often come with monthly fees and transaction limits, similar to personal checking accounts. Many banks cap the number of free transactions and charge fees for exceeding deposit or withdrawal limits. While business checking accounts generally offer low interest rates - frequently under 1% - some digital-first banks stand out. In June 2025, Bluevine offered a business checking account with a 2.0% APY on balances up to $250,000, with no monthly or overdraft fees.

In addition to checking accounts, businesses can take advantage of savings and money market accounts to manage surplus funds effectively.

Business Savings and Money Market Accounts

Business savings accounts are ideal for setting aside funds for emergencies, expansions, or major purchases. They also help segregate money for quarterly taxes and payroll. As of June 2025, the average national interest rate for business savings accounts was 0.38%, though high-yield options offered APYs exceeding 4%.

Money market accounts (MMAs) provide a balance between savings and checking features. They typically offer higher interest rates than standard savings accounts - averaging 0.59% in June 2025, with top-tier options surpassing 4% - while allowing limited check-writing and debit card access. However, MMAs often require higher minimum balances, usually $10,000 or more. Even though federal rules limiting savings withdrawals to six per month were lifted in 2020, many banks still enforce this restriction or impose fees for excessive withdrawals.

For businesses with surplus cash, Certificates of Deposit (CDs) are another option. CDs allow funds to be locked in for periods ranging from six months to five years, offering higher, fixed returns. This makes them a solid choice for businesses seeking predictable growth on idle cash.

DashK12 and Financial Literacy

Understanding and choosing the right account type is just one piece of the puzzle. Financial literacy plays a vital role in business success. DashK12 provides tools like classroom-ready resources, self-paced courses, and slide decks to help entrepreneurs understand the long-term implications of their financial choices. These materials cover essential topics such as separating personal and business finances, managing cash flow, and building reserves. Whether you're teaching Career and Technical Education (CTE) courses or starting a new venture, DashK12’s resources offer practical insights to navigate the banking world with confidence.

How to Choose the Right Bank Accounts

Matching Accounts to Your Goals

Choosing the right bank account starts with understanding your financial goals. Are you looking for a place to manage daily expenses? A checking account is perfect for everyday spending, like paying bills or receiving paychecks. Planning to save for a rainy day or a dream vacation? A savings account provides a secure spot to grow your funds while earning a bit of interest. If you’re saving more substantial amounts but still want occasional access, money market accounts might be a better fit since they often offer higher interest rates than standard savings accounts.

For those who can set aside money for a fixed period, certificates of deposit (CDs) are a great option. They lock in your funds at higher, fixed interest rates. For example, as of June 2025, the average one-year CD offered a 1.62% yield, with some high-yield options exceeding 4%. Experts often suggest maintaining both a checking and a savings account to balance short-term cash flow with long-term savings. If you’re a business owner, having separate business checking and business savings accounts is essential. These accounts help you manage daily operations and set aside funds for taxes or future growth, keeping personal and professional finances separate.

It’s also worth paying attention to fees. Checking accounts typically charge monthly maintenance fees between $5 and $15, but these fees are often waived if you maintain a minimum balance or set up direct deposits. If you frequently use ATMs, look for banks with widespread fee-free networks or those that reimburse ATM fees. Online-only banks are another option to consider - they often offer higher interest rates and lower fees due to reduced operating costs.

By keeping these factors in mind, you can find an account that aligns with both your financial goals and your need for convenience.

Account Comparison Table

Here’s a quick breakdown of the main account types and their features:

| Account Type | Primary Purpose | Access Level | Typical Fees | Best For |

|---|---|---|---|---|

| Checking | Everyday spending & bill pay | High (Debit card, checks, ATMs) | Monthly ($5–$15), Overdraft (≈$15), ATM (≈$3) | Daily transactions, receiving paychecks |

| Savings | Short-term goals & emergencies | Medium (Transfers, limited withdrawals) | Monthly (if below minimum) | Emergency funds, vacation savings |

| Money Market (MMA) | Higher interest with some access | Medium (Limited check-writing or debit card) | Monthly maintenance, Minimum balance | Larger emergency funds, home down payments |

| Certificate of Deposit (CD) | Fixed-term growth | Low (Locked until maturity) | Early withdrawal penalty | Long-term savings with a specific timeline |

| Business Checking | Business operations | High (Employee cards, wire transfers) | Transaction fees, Monthly | Small business owners, freelancers |

| Business Savings | Business cash reserves | Medium (Transfers) | Monthly (if below minimum) | Tax reserves or profit storage |

For long-term savings, consider using a CD ladder to stagger maturity dates, giving you consistent access to funds while earning higher interest rates. Additionally, linking your checking and savings accounts can provide automatic overdraft protection. Remember, all FDIC-insured accounts safeguard deposits up to $250,000 per depositor.

Conclusion

Getting your finances in order begins with giving each bank account a specific purpose - use a checking account for everyday spending, a savings account for emergencies, and CDs for fixed-term growth. Financial professionals often advise having at least one checking account for easy access to funds and one savings account for building long-term stability. This structured approach, as discussed earlier, helps keep your financial plan practical and adaptable.

For medium-term goals, like saving for a home down payment, high-yield savings accounts and money market accounts can offer much better returns compared to standard options. Meanwhile, business owners can benefit greatly from dedicated business accounts, which not only simplify tax preparation but also help safeguard personal assets by keeping business and personal finances separate.

"Understanding the different types of bank accounts is the first step to managing your money with confidence." - Catherine Hiles, Certified Financial Education Instructor

FAQs

What’s the difference between a savings account and a money market account?

A savings account is a straightforward way to earn interest on funds you don’t plan to use immediately. These accounts typically come with low or no minimum balance requirements and provide a modest annual percentage yield (APY). However, they usually limit the number of withdrawals or transfers you can make each month and don’t include features like check-writing or debit card access.

A money market account offers a mix of savings and checking account features. While these accounts often require a higher minimum balance, they may provide a comparable or slightly better APY. Plus, they offer added flexibility, such as limited check-writing privileges or a debit card for transactions.

If you’re saving for short-term goals or have a smaller balance, a savings account is a practical choice. On the other hand, a money market account is a better fit if you can maintain a higher balance and need more transaction options.

Is a Certificate of Deposit (CD) the right choice for my savings goals?

A Certificate of Deposit (CD) can be a solid choice if you're aiming for a secure way to grow your savings and don’t need immediate access to the funds. Unlike regular savings accounts, CDs usually come with fixed, higher interest rates, making them attractive for those seeking predictable returns. However, they do require you to commit your money for a specific period.

Before opening a CD, think about whether you can meet the minimum deposit requirement and whether you're okay with the possibility of early-withdrawal penalties if you need the funds before the term ends. For those saving toward a particular goal and wanting steady growth, a CD might be worth considering.

What factors should I consider when deciding between a personal and business bank account?

When deciding between a personal and business bank account, it’s essential to consider how you plan to use the account and what features are most important to you. Personal accounts, like checking or savings accounts, are designed for individual use. They’re perfect for managing day-to-day expenses or setting aside money for personal goals. In contrast, business accounts are specifically built for companies and come with features like separating personal and business finances, liability protection, and tools to manage business-related expenses.

If you’re running a business - even a small one - a business account can make a big difference. It helps keep your financial records organized and simplifies tax reporting. That said, business accounts often come with higher fees or specific eligibility requirements, so it’s a good idea to shop around and compare options to find one that suits your needs.