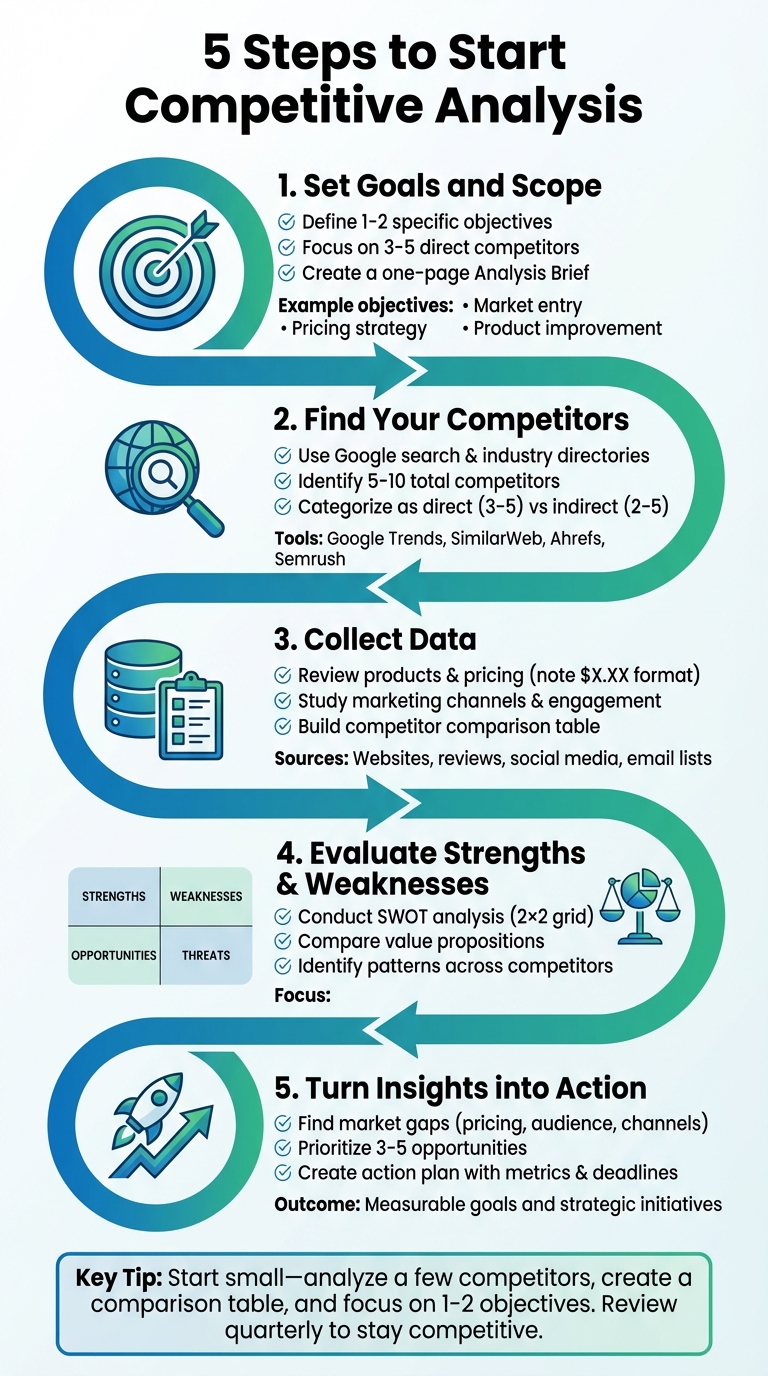

5 Steps to Start Competitive Analysis

Competitive analysis helps businesses understand their market position by studying competitors' strategies, strengths, and weaknesses. This process is essential for identifying opportunities, refining pricing, improving products, and enhancing customer experience. Here's a quick guide to get started:

- Set Goals and Scope: Define clear objectives (e.g., pricing strategy, market entry) and narrow your focus to specific competitors, areas, and timeframes.

- Identify Competitors: List 5–10 competitors, distinguishing between direct (similar products) and indirect (alternative solutions).

- Collect Data: Research competitors' pricing, products, marketing, and customer feedback using websites, reviews, and tools like Google Trends or Semrush.

- Evaluate Strengths and Weaknesses: Perform a SWOT analysis to highlight competitors' strengths, weaknesses, opportunities, and threats.

- Turn Insights into Action: Identify market gaps, prioritize opportunities, and create actionable plans with measurable goals.

Key Tip: Start small - analyze a few competitors, create a comparison table, and focus on one or two objectives. Regularly revisit and update your analysis to stay competitive.

5-Step Competitive Analysis Process for Businesses

How To Conduct a Competitive Analysis (FREE Template)

Step 1: Set Your Goals and Scope

Start by clearly defining the purpose of your analysis. This step ensures your efforts are directed toward gathering information that supports a specific business decision - whether that's entering a new U.S. market, revising your pricing model, or improving customer retention. Without clear goals, you risk wasting time on irrelevant metrics that don't contribute to strategic decisions. Establishing this clarity helps you outline precise objectives.

Define Your Objectives

Turn general goals into specific, measurable objectives. For example, instead of saying "grow revenue", specify "identify two underserved segments and estimate potential monthly revenue in dollars." Similarly, instead of "get more customers", aim for something like "analyze funnel steps for five competitors and identify three website or ad improvements to boost conversion rates".

Some common types of objectives include:

- Market entry: For instance, "Determine if we can profitably launch a new product line in the Midwest within 12 months."

- Product improvement: Such as "Identify 3–5 must-have features we're missing compared to top competitors."

- Pricing strategy: Example: "Evaluate if we can increase prices by 5–10% while staying competitive."

- Marketing and positioning: For example, "Clarify how our brand can stand out against three main competitors in messaging and value proposition".

To keep your analysis manageable, focus on one primary objective and one secondary objective. Once these are set, you can define a clear scope to ensure your insights are actionable.

Narrow Your Focus

Refine your scope by addressing four key dimensions:

- Competitor set: Identify 3–5 direct competitors and 1–2 indirect alternatives.

- Focus areas: Choose specific aspects to analyze - pricing, products, demographics, channels, or customer experience - based on your objectives.

- Geographic scope: For a U.S.-based business, decide if you’re analyzing national competitors, local or regional players, or a mix. Regional differences in pricing, shipping policies, and promotions can be significant.

- Time frame: Determine whether you’re examining the current landscape or trends over the past 6–12 months, such as price changes, new product launches, or shifts in marketing strategies.

Summarize your scope in a one-page Analysis Brief. This document should include:

- Your business goal (e.g., "Increase average monthly revenue by 15% within 12 months").

- Primary analysis objective (e.g., "Understand how 4–6 U.S. competitors price and package similar services to refine our tiers").

- Competitor scope (specific names and types).

- Focus areas (e.g., "Pricing, product features, and customer reviews only").

- Geographic and audience focus (e.g., "U.S. K–12 educators and small education-focused businesses").

- Key metrics to track, such as price ranges in USD, free trial durations, average review scores, number of plans, and differentiating features.

Creating and sharing this brief ensures everyone on your team is aligned with the analysis strategy. DashK12's consulting services can also assist in refining your KPIs and narrowing down your competitor list.

Step 2: Find Your Direct and Indirect Competitors

After setting your goals, the next step is to compile a detailed list of competitors. Direct competitors are those offering similar products or services to the same audience, while indirect competitors meet the same customer needs but with different solutions. Understanding both types gives you a clearer picture of the competitive landscape and highlights potential challenges. Here's how to gather and organize competitor data effectively.

Use Online Tools to Research Competitors

Start by conducting a Google search using relevant keywords. Take note of the top 5–10 brands that appear on the first page. Check out "people also ask" sections and related searches to uncover indirect competitors. Tools like Google Trends and SimilarWeb can help you compare search interest and identify audience overlap. For deeper insights, consider free trials of platforms like Ahrefs or Semrush to discover which competitors rank for your keywords and analyze their backlink profiles. Additionally, services like SparkToro or Buzzsumo can show you the brands your target audience follows and shares.

Industry directories such as Crunchbase, G2, or Capterra are excellent resources for finding competitors within your category. Review sites like Trustpilot or Yelp often mention alternatives based on customer reviews, and browsing U.S. industry conferences on Eventbrite can help you identify emerging competitors. You can also gather valuable insights by asking your customers which options they considered before choosing your product or what alternatives they currently use alongside yours.

Group Competitors by Type

Once you've collected the data, organize it by categorizing competitors into direct and indirect types. Create a table with columns for competitor name, type (direct or indirect), target market, and priority level based on factors like market share and audience overlap. Aim to identify 5–10 competitors in total, with 3–5 being direct competitors and 2–5 as indirect alternatives.

For example, if you own a coffee shop in Seattle, your direct competitors might include Starbucks and Peet's, while indirect competitors could range from tea-focused shops like Teavana to energy drink brands like Red Bull. To maximize your efforts, focus your detailed analysis on 3–5 competitors with the largest U.S. market share.

Step 3: Collect Data on Competitors

To understand your market better, gather detailed insights about your competitors - what they offer, how they price their products, and the ways they engage with customers. Use publicly available sources like their websites, social media profiles, customer reviews, and advertising campaigns to collect this information.

Review Products and Pricing

Start by visiting competitor websites and documenting their product offerings, features, pricing tiers, and payment structures. Be sure to note prices in the $X.XX format and specify whether they are one-time payments, monthly subscriptions, or annual fees. For example, one competitor might have a basic plan for $19.99/month, a mid-tier plan at $49.99/month, and a premium option priced at $199.00/year. Include any additional fees, discounts (such as "10% off annual plans" or "first month for $1"), trial policies, and bundle deals to ensure you can make accurate comparisons later.

If pricing details aren’t readily available, dig deeper. Look for downloadable pricing sheets or rate cards often linked in the footer of their websites. You can also simulate a checkout process to uncover hidden costs or sign up for free trials to access pricing details. Third-party review platforms often provide price estimates, and customer reviews may reveal what people actually paid. For service-based businesses, consider requesting a quote as a "mystery shopper" using a generic email to see how they structure their pricing and proposals.

Once you’ve captured their pricing strategies, shift your focus to how they connect with their audience.

Study Marketing and Customer Engagement

After pricing, analyze your competitors’ marketing efforts. Explore their primary channels, such as website blogs, email newsletters, and social media platforms like Facebook, Instagram, LinkedIn, and YouTube. Pay attention to posting frequency, content types, engagement levels, and how they respond to customer inquiries. Subscribe to their email lists to observe their welcome emails, subject lines, and promotional patterns over a few weeks. This will give you a sense of how they nurture leads and drive conversions.

Customer reviews provide another layer of insight. Check platforms like Google, Yelp, and Amazon, as well as testimonials on their websites and social media comments. Record average star ratings and group feedback into themes. For example, note frequent compliments like "quick delivery" or "excellent customer service" and common complaints such as "confusing pricing" or "poor product quality." These reviews often reveal strengths and weaknesses that polished marketing materials might hide.

Build a Competitor Comparison Table

Create a table to organize your findings and compare competitors side by side. Include 3–5 competitors, categorizing them as direct or indirect, and add rows for critical factors like products, price ranges, features, target audience, marketing channels, average review ratings, strengths, and weaknesses. For example:

| Competitor | Products/Services | Price Range | Features | Average Rating | Strengths | Weaknesses |

|---|---|---|---|---|---|---|

| A | One-on-one tutoring | $40/hour | Flexible scheduling | 4.8/5 | Personalized help | High cost |

| B | Group classes | $25/hour | Strong app | 4.1/5 | Affordable pricing | Limited subject range |

| C | National platform | $30–$60/hour | Wide subject coverage | 3.9/5 | Broad reach | Mixed customer support |

This table makes it easier to identify each competitor’s strengths, weaknesses, and market position. With this visual breakdown, you’ll be better equipped to spot gaps in the market and refine your strategy in the next steps.

sbb-itb-4f1eab7

Step 4: Evaluate Strengths, Weaknesses, and Position

After gathering detailed competitor data, the next step is to evaluate their strengths, weaknesses, and overall market positions. This analysis helps pinpoint gaps and opportunities your business can leverage.

Conduct a SWOT Analysis

A SWOT analysis is a simple yet effective tool for breaking down competitors' internal strengths and weaknesses alongside external opportunities and threats. To get started, create a 2×2 grid for each of your key competitors. Here's how to approach each section:

- Strengths: Identify what competitors excel at. Look at customer reviews to find consistent praises, such as fast shipping, responsive customer service, competitive pricing, or strong brand recognition. Operational advantages like a large social media following or exclusive partnerships should also be noted.

- Weaknesses: Highlight recurring complaints or shortcomings. These might include slow response times during U.S. business hours, confusing pricing models, limited product features, or gaps in service coverage.

- Opportunities: Focus on external trends that could benefit competitors. Examples include rising demand in specific niches, new state or federal initiatives, growing interest in online education, or advancements in technology.

- Threats: Pinpoint risks competitors face, such as new low-cost entrants in the market, regulatory changes, supply chain issues, or economic downturns that impact consumer spending.

Research supports the value of structured competitive analysis. According to Gartner, companies that regularly conduct such evaluations are more likely to meet or exceed revenue goals. Meanwhile, the U.S. Small Business Administration highlights poor competitive research as a common reason for early business failures.

Once you’ve completed a SWOT analysis for your top three to five competitors, review the grids for patterns. For instance, if multiple competitors struggle with onboarding or customer support, this could indicate an underserved area your business could address. Similarly, if most competitors position themselves as either premium or budget options, you might find an opportunity to establish a distinct niche.

With the SWOT grids in hand, the next step is to analyze how competitors communicate their value to customers.

Compare Value Propositions

A value proposition explains who a product or service is for, what problem it solves, and how it is better or different from alternatives. To compare value propositions, visit each competitor’s homepage and examine their main headline or "Why Us" section. Break their messaging into four key components:

- Target Customer: Who they are aiming to serve.

- Main Benefit: The primary problem they solve or value they offer.

- Supporting Proof: Evidence like testimonials or claims (e.g., "trusted by 5,000 U.S. schools").

- Differentiators: What sets them apart from others.

To make this analysis easier, create a comparison table. Each row should represent a competitor, and the columns can include details like their target audience, core value proposition, key strengths, main weaknesses, and pricing tier (budget, mid-range, or premium). Be sure to include your business in the table for direct comparison.

This exercise will reveal overlaps and gaps in the market. For example, if all competitors focus on low prices but reviews frequently mention poor customer support, you could stand out by offering mid-range pricing paired with exceptional, U.S.-based support. Similarly, you might identify underserved segments, such as small businesses or local schools, and tailor your messaging to meet their needs.

Step 5: Turn Findings into Action

Now that your competitor analysis is complete, it’s time to put those insights to work. The next step is all about transforming what you’ve learned into strategies that strengthen your position in the market.

Find Market Opportunities

Start by identifying areas where competitors consistently fall short. Pricing gaps are one example - if most competitors are clustered around $99/month, you could stand out by offering a lower-cost option, like a $39 starter plan for budget-conscious customers. Audience gaps might appear if competitors focus on enterprise clients but overlook freelancers or small businesses. Meanwhile, channel or messaging gaps could exist if few competitors are active on platforms like TikTok or YouTube, or if their messaging fails to address recurring customer pain points.

Look closely at your analysis to spot these "blank spots." Are there features, services, or content that no one else is offering? Are there repeated complaints in customer reviews that no one seems to address? These are your opportunities. For each one, write an opportunity statement connecting your strengths to a competitor's weakness. For example, if your shipping is faster, you could highlight "2-day U.S. delivery compared to competitors’ 5–7 days." Then, prioritize 3–5 opportunities that align with your goals, fit your budget, and have a clear potential impact.

Create Your Action Plan

Turn your opportunities into a clear, actionable plan. Start by defining the objective for each initiative in one concise sentence tied to your competitive insight. For instance: "Capture 5% more U.S. college students within 12 months by offering a lower-cost plan than Competitor A." Then, break it down into specific actions, such as: "Launch a $19.99/month student plan with a dedicated landing page and Instagram ads targeting U.S. students aged 18–24."

Assign each task an owner, set a timeline (e.g., 03/01/2026–04/15/2026), estimate resources and budget (e.g., $3,000 for ads; 20 design hours), and define 2–3 success metrics like conversion rates, new customers, or average order value. Keep everything organized on a simple one-page template or spreadsheet - Google Sheets works well for this. Include your SWOT summary, prioritized initiatives, deadlines, and status updates.

To evaluate potential initiatives, score them on impact, effort, and risk using a 1–5 scale. Focus first on "high-impact, low-to-medium-effort" items. For example, updating website messaging to highlight a unique feature competitors lack is a low-cost, quick action that can significantly boost conversions. Revisit and adjust your plan quarterly as new competitor data comes in.

Get Help from DashK12

Need extra support? Turning insights into actionable strategies can be tough, especially for small businesses with limited time or resources. That’s where DashK12 comes in. Their business consulting services can help review your analysis, validate your opportunity statements, and build a customized action plan tailored to your industry and local market. DashK12 has a proven track record of helping small businesses in Texas achieve measurable growth - often within just 90 days. They’ve helped businesses refine marketing strategies, simplify operations, create recurring revenue models, and strengthen brand positioning. For instance, one client saw 300% growth, while another rapidly expanded their content offerings - all in under three months.

"They are very client-centered and innovative and were able to provide excellent services that have improved our technology approach." - Dr. Akweta Hickman, CEO, Amoxie Group

DashK12 also offers CTE resources and educational courses to help your team effectively apply competitive analysis findings. Whether you need help prioritizing initiatives, crafting marketing messages based on your differentiators, or setting up monitoring systems, DashK12 can guide you through the process. Their consulting and training programs ensure your action plan seamlessly integrates with the competitive strategy you’ve developed. Check out DashK12 to see how they can support your business growth.

Conclusion

Competitive analysis doesn’t have to be complicated. This guide walks you through the essentials: setting clear goals, identifying competitors, gathering data, assessing strengths and weaknesses, and turning those insights into actionable steps. These practical strategies provide a solid foundation for understanding your market position and staying ahead.

The most important takeaway? Make competitive analysis a regular practice. Markets evolve - new players enter, customer preferences shift, and trends emerge. By reviewing your analysis periodically, you’ll avoid making decisions based on outdated information.

Start simple. Pick a few competitors, create a one-page comparison table, and draft a quick SWOT analysis. Even this basic approach can uncover useful insights. From there, focus on 3–5 specific initiatives, set clear deadlines, and assign responsibilities to ensure follow-through.

For additional resources and expert advice, check out DashK12 to sharpen your competitive strategy.

FAQs

What are the best ways to collect competitor data for my business?

To collect competitor data efficiently, consider blending various tools and resources. Begin with business consulting services, such as those from DashK12, which offer tailored strategies and expert insights to fit your goals. Pair this with social media analytics tools to track competitor engagement and activity trends. For deeper insights, tap into industry-specific databases and online market research platforms to access detailed information about your competitors' strategies and performance.

What’s the best way to prioritize opportunities from a competitive analysis?

To sort through opportunities effectively, weigh their potential impact alongside their feasibility. Think about key elements like market demand, your unique edge over competitors, and the resources required to act on them. Zero in on opportunities that not only align with your business objectives but also promise the best return on investment.

If you're looking for extra support, tools such as DashK12's business coaching can provide valuable insights to help you fine-tune your priorities and craft a focused, strategic action plan.

What mistakes should I avoid when conducting a competitive analysis?

To make your competitive analysis truly effective, steer clear of these common missteps:

- Looking only at direct competitors: Don’t overlook indirect competitors - they can influence your market share and attract your customers just as much.

- Relying on outdated or incorrect data: Insights are only as good as the information they're based on. Make sure your data is current and accurate.

- Overlooking customer feedback and market trends: These are invaluable for understanding how your competition operates and identifying gaps in the market.

- Neglecting regular updates: Markets shift quickly, and failing to revisit your analysis can leave you working with irrelevant information.

Avoiding these traps will help keep your competitive analysis sharp, relevant, and aligned with your business objectives.