Breach Of Contract: Legal Basics For Small Businesses

A breach of contract can disrupt your business, hurt cash flow, and damage your reputation. Whether it’s a missed payment, delayed delivery, or subpar work, understanding how to handle breaches is critical for protecting your business. Here’s what you need to know:

- What it is: A breach occurs when one party fails to meet their contractual obligations, either partially or entirely.

- Types: Breaches can be material (major issues) or minor (smaller deviations).

- Proof: To pursue legal action, you must show a valid contract, the breach, financial losses, and a direct connection between the breach and those losses.

- Remedies: Options include compensatory damages, contract termination, or dispute resolution methods like mediation or arbitration.

- Prevention: Use clear, detailed contracts with defined terms, deadlines, and remedies. Track obligations and maintain thorough documentation.

Contract Law Basics for Small Businesses

What Makes a Contract Legally Binding

For a contract to stand up in U.S. courts, it needs five key elements: offer, acceptance, consideration, capacity, and legality. Let’s break these down. An offer is a clear, specific proposal. For example: “We will supply 1,000 custom-printed T-shirts at $8.00 per shirt, delivered by March 15, 2026.” The terms must be precise enough for a court to interpret them. Acceptance means agreeing to those exact terms without changes - any modification turns it into a counteroffer.

Consideration refers to the exchange of something valuable, like money, goods, or services. For instance, a coffee shop paying a designer $750 for a logo and branding guide is a valid example of consideration. Both parties must also have capacity, meaning they are adults of sound mind and legally authorized. Lastly, the contract must serve a legal purpose - agreements involving illegal activities (like tax fraud or unlicensed medical services) won’t hold up in court.

It’s crucial to spell out these elements clearly. Vague terms like “we’ll pay you a fair amount” or open-ended promises like “agreements to agree” often fail in court because they lack precision. These foundational principles pave the way for understanding how different contract formats affect enforceability.

Written, Oral, and Electronic Contracts

In the U.S., contracts can take the form of written, oral, or electronic agreements, and all three can be legally binding - though each comes with its own set of challenges. Written contracts are typically the easiest to enforce because the terms are documented, leaving little room for interpretation. Oral contracts, while valid, are harder to prove as they often rely on memory or informal evidence, like text messages. Additionally, some agreements - such as those involving real estate, high-value transactions, or deals that can’t be completed within a year - must be in writing under the Statute of Frauds.

Electronic contracts, including clickwrap agreements and e-signatures, are widely recognized under the federal E-SIGN Act and state laws like the Uniform Electronic Transactions Act. For these to be enforceable, users must have a clear chance to review the terms and indicate consent, often by checking a box or typing their name. For small businesses, using written or electronic contracts for significant transactions is the safest route. If you make an oral agreement, follow it up with a confirmation email and store all digital confirmations securely. Clear, documented terms are essential, as we’ll see in the next section on protective contract clauses.

Contract Clauses That Protect Your Business

Once you’ve ensured your contract is enforceable, the next step is crafting clauses that protect your business. Start with payment terms. Specify the total price (in U.S. dollars), due dates, invoicing schedules, late fees (e.g., 1.5% per month on overdue amounts), and consequences for nonpayment, such as suspending services.

Define the scope of work clearly. This means outlining deliverables, quantities, revisions, and any exclusions. Vague or undefined scopes are a common source of disputes. If timing is critical, include deadlines and milestones with specific start and end dates.

Warranties and disclaimers are also important. For example, you might promise a 90-day workmanship warranty while limiting any implied guarantees, as allowed by law. To manage potential risks, add a limitation of liability clause. You might state, for instance, “Our liability will not exceed fees paid in the last 12 months,” and exclude indirect losses where permitted.

A dispute resolution clause can save time and money by outlining how disputes will be handled - whether through negotiation, mediation, arbitration, or litigation. Be sure to specify the governing law (e.g., Texas law) and the venue for resolving disputes. Finally, a termination clause should explain the conditions under which either party can end the contract, including notice periods and what happens to payments or obligations upon termination.

These clauses act as safeguards, helping you avoid misunderstandings and protecting your business if things go wrong.

Understanding Contract Breaches Causes, Types, and Legal Remedies

Types and Elements of Breach of Contract

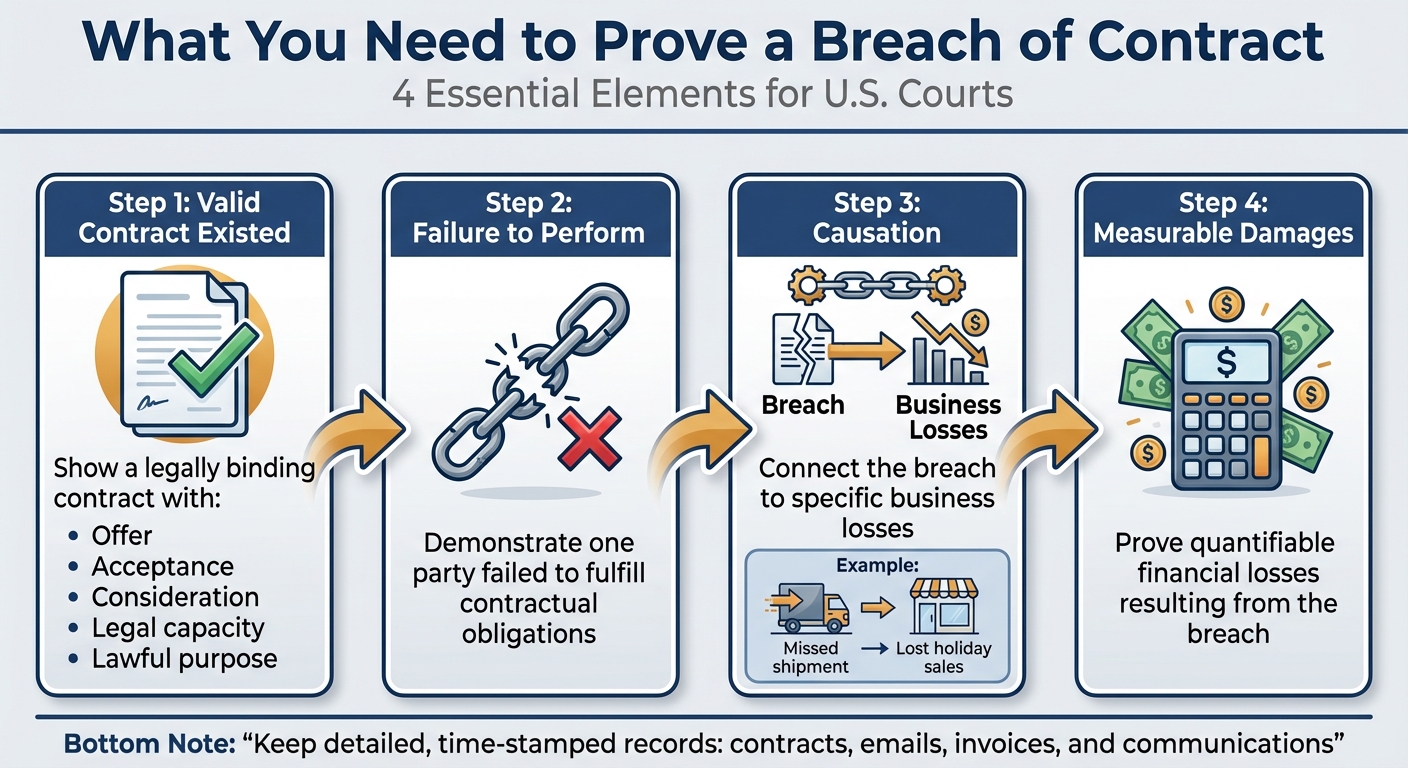

4 Steps to Prove Breach of Contract in Court

What You Need to Prove a Breach

To succeed with a breach of contract claim in U.S. courts, you'll need to establish four key elements. First, you must show that a valid contract existed, which includes an offer, acceptance, consideration, legal capacity, and a lawful purpose. Second, you need to demonstrate that one party failed to fulfill its contractual obligations. Third, you must connect the breach to specific business losses (causation). Finally, you have to prove measurable damages resulting from the breach.

For instance, imagine a retailer using a signed purchase order to confirm the existence of a contract. If the wholesaler fails to ship the goods, the retailer can argue this breach led to missed holiday sales, directly linking the breach to financial losses. To build a strong case, keep detailed, time-stamped records like contracts, emails, and invoices.

4 Main Types of Contract Breaches

When dealing with breaches, they generally fall into four main categories:

- Material breach: A significant failure that undermines the heart of the contract. For example, a contractor missing a major build-out deadline could qualify as a material breach.

- Minor breach: Also known as an immaterial or partial breach, this involves smaller deviations that don’t significantly impact the overall agreement. For instance, a one-day delay in delivery might not disrupt the project’s outcome.

- Actual breach: This occurs when a party outright fails to perform as promised. Think of a client who doesn’t pay an invoice on time or a vendor who delivers only part of the agreed-upon inventory.

- Anticipatory breach: This happens when a party signals in advance that they won’t fulfill their obligations. For example, if a supplier emails you months before a deadline to say, “We can’t fulfill your contract this year,” you can treat the contract as breached and make alternative plans.

How Breaches Affect Your Business

Understanding the impact of breaches is just as important as proving them. A breach can lead to direct costs and lost profits, such as paying higher rates to secure last-minute vendors or missing out on sales opportunities. Operational disruptions are another concern - production might grind to a halt, customer deadlines could be missed, and staff might be left idle while you scramble to replace goods or services.

On top of that, breaches can damage your reputation. Late orders or quality issues may lead to negative customer reviews, loss of repeat business, and higher customer acquisition costs over time. These ripple effects can be just as damaging as the immediate financial losses.

Legal Remedies and Dispute Resolution

Legal Remedies for Contract Breaches

When a contract is breached, U.S. law offers several remedies to help you recover financially. Compensatory damages are designed to cover both direct losses, like unpaid invoices, and indirect losses, such as revenue lost due to operational disruptions. These damages aim to restore you to the financial position you would have been in had the contract been fulfilled.

Restitution is another remedy that essentially undoes the transaction. For example, if you paid a deposit to a contractor who never started the work, restitution would require the return of your money and the cancellation of the agreement. Some contracts include liquidated damages clauses, which specify a fixed penalty - like $500 per day of delay. These are enforceable only if they reasonably estimate the potential harm caused by the breach.

Other remedies include specific performance, where a court orders the breaching party to fulfill their obligations. This is typically reserved for unique situations, such as real estate or custom-made goods. In cases of a material breach, you may also have the right to terminate the contract, allowing you to end the agreement while still seeking compensation for any losses you’ve already suffered.

Ways to Resolve Contract Disputes

Not all disputes need to escalate to a courtroom. Negotiation is often the fastest and most cost-effective way to resolve issues. It allows both parties to work together toward a solution that works for everyone, making it a great option for preserving business relationships. However, its success relies on both sides being willing to compromise.

If negotiation doesn’t work, mediation can be a helpful next step. In mediation, a neutral third party facilitates discussions in a private and confidential setting, often leading to quicker and less expensive resolutions than litigation. If mediation fails, arbitration is another option. In arbitration, a neutral arbitrator hears both sides and makes a binding decision. While it’s generally faster and more private than going to court, arbitration can involve fees and offers limited opportunities for appeal.

For more complex or formal disputes, litigation may be necessary. While filing a lawsuit provides access to tools like discovery, appeals, and court enforcement, it is often expensive, time-consuming, and conducted in public. Many small business owners start with negotiation or mediation and escalate only if needed, balancing costs with potential outcomes. Acting quickly is key, as legal claims come with strict deadlines.

Time Limits for Taking Legal Action

Each state has its own statutes of limitations, which set deadlines for filing a breach of contract lawsuit. Missing these deadlines can result in your case being dismissed, regardless of its validity. For written contracts, the time limit in most states is around four years from the breach date, though this can vary from three to six years depending on the jurisdiction. Oral contracts usually have shorter deadlines, typically between two and four years.

For contracts involving the sale of goods, the Uniform Commercial Code (UCC) generally imposes a four-year limit, though parties can agree to shorten this period (but not to less than one year). Because these deadlines differ by state and contract type, it’s crucial to act quickly when a breach occurs. Reviewing your contract, keeping detailed records, sending written notices, and consulting an attorney early can help ensure you meet all filing deadlines and protect your rights to pursue a claim.

sbb-itb-4f1eab7

Practical Steps for Small Businesses

How to Prevent Contract Breaches

The best way to avoid contract disputes is by having clear, detailed written agreements that outline every obligation, deadline, payment term, and remedy before anyone signs. For significant deals, always rely on written contracts to minimize legal risks. These contracts should include specific details such as:

- What will be delivered: Clearly define the goods or services.

- Delivery timelines: Use precise dates in the U.S. format (e.g., 03/15/2026).

- Quality standards and acceptance criteria: Specify the standards expected.

- Payment schedules: Include amounts in U.S. dollars and due dates.

- Breach definitions: Clearly state what constitutes a breach.

In addition to drafting strong contracts, set up internal systems to track obligations. Use tools like calendars with automated reminders (e.g., 30, 14, and 7 days before deadlines) to stay on top of key dates. Assign a designated "contract owner", such as a project manager or department head, to oversee compliance and address potential issues immediately.

Keeping organized records is just as important. Maintain supporting documents like purchase orders, delivery receipts, change orders, timesheets, work logs, and emails that document approvals or changes. These records can help demonstrate your business met its obligations - or highlight where the other party fell short. By addressing potential ambiguities upfront, you can significantly reduce the risk of breach claims.

What to Do When a Breach Occurs

If you suspect a breach, the first step is to carefully review the entire contract. Pay close attention to the specific clause in question, noting any definitions of material versus minor breaches. Also, check for provisions regarding notice periods, cure periods, and available remedies. Verify the facts by reviewing dates, performance records, invoices, and communications to determine whether the breach is partial, ongoing, or already resolved.

Document everything immediately. Create a timeline of events and save all related communications - emails, texts, letters, call notes, photos, and system logs. Track the financial impact in U.S. dollars to quantify any losses. Next, send a written notice (via both email and letter) that outlines the breached provisions, relevant facts, and your proposed remedy. For example, you might request the issue be resolved within a specific timeframe, propose a revised schedule, or ask for a refund. Keep your communication neutral and factual - avoid inflammatory language, as it could hurt your position if the situation escalates.

Before considering litigation, try to resolve the issue through negotiation or mediation. Offer practical solutions like adjusted deadlines, refunds, or substitute performance. If informal efforts fail, consult a business or contract attorney to assess the strength of your claim, potential damages, and whether pursuing litigation or settlement is the better option. Having clear internal policies in place will support these steps and help you handle breaches more effectively.

Employee Training and Company Policies

To reduce risks and improve contract management, establish written policies and provide training for key staff. These policies should cover:

- Authorization guidelines: Specify who can sign contracts and set dollar limits for signing authority.

- Legal reviews: Require legal input for deals above a certain dollar threshold.

- Documentation procedures: Outline how contracts should be stored and approvals recorded.

- Escalation processes: Define steps for reporting potential breaches, such as notifying a manager or the owner within one business day.

Train employees on the basics of contract law and how to handle scope changes using written change orders. Encourage them to document important interactions with vendors, customers, and partners through follow-up emails summarizing calls or meetings. Periodic audits of contract performance and compliance - using checklists or internal reviews - can help identify recurring issues. These reviews also offer an opportunity to update contract templates or refine company policies for better outcomes.

DashK12 Resources for Small Businesses and Educators

Business Consulting Services

For small businesses and educators shaping future entrepreneurs, understanding contract law is essential. DashK12’s business consulting services focus on helping U.S. businesses refine their contract practices with tailored support:

- Contract template reviews to ensure precise language and completeness

- Custom drafting assistance for clear, straightforward agreements

- Risk-mapping sessions to identify and address potential breach points

During a template review, consultants pinpoint vague language or missing clauses like payment terms, dispute resolution, warranties, and liability limitations, ensuring documents comply with U.S. standards. Custom drafting services help business owners craft plain-English agreements for common needs, such as vendor contracts, client service agreements, independent contractor arrangements, and NDAs.

Risk-mapping sessions take a closer look at your processes - whether in sales, hiring, or procurement - to identify common pitfalls, such as unclear scopes of work or delivery timelines. Practical fixes are then recommended. DashK12 can also assist with rolling out new templates across CRM or proposal tools, training staff on proper usage, and establishing review checkpoints before contracts are signed. If a breach or dispute has already occurred, consultants can examine your internal workflows to find where misunderstandings began and help design better templates for updates, change requests, or delay notices. These services not only strengthen contract practices for businesses but also provide valuable insights for classroom lessons.

Classroom and CTE Resources

DashK12 offers high school and CTE educators engaging resources to teach contract law and breach-of-contract concepts through real-world examples. Slide decks simplify core contract elements - offer, acceptance, consideration, capacity, and legality - using relatable scenarios like a student-run T-shirt business or catering for a school event.

Project-based modules immerse students in role-play situations, such as hiring a freelancer, dealing with late deliveries for a school dance, or managing defective inventory. Students analyze contract terms, identify breaches, and explore possible solutions.

Self-paced courses feature short video lessons explaining U.S. contract law in easy-to-understand language, interactive case studies where students decide how a business handles issues like late payments or scope creep, and downloadable checklists for reviewing contracts. Scenario-based quizzes challenge students to distinguish between minor and material breaches or determine whether a situation is a misunderstanding or a true breach. These resources align with U.S. CTE standards, ensuring students develop the legal knowledge they’ll need in the workplace.

Tools for Entrepreneurs

DashK12 also provides entrepreneurs with practical tools to manage contracts effectively. Their plain-language e-books and fillable templates simplify drafting and organizing agreements, while contract tracking tools help monitor key dates and obligations.

The e-books guide small business owners through essential contract topics, such as structuring service agreements, spotting red flags, and knowing when to consult an attorney. Templates cover a range of needs, including client service agreements, independent contractor agreements, NDAs, purchase orders, and simple partnership MOUs. Each template adheres to U.S. legal standards and includes helpful prompts like “Insert your state here” or “Describe deliverables clearly.”

Contract tracking tools, such as spreadsheets and checklists, help owners track critical details like parties involved, effective dates, payment schedules, milestones, and dispute-resolution terms. Paired guidance shows how to set reminders for deadlines, log performance issues, and create follow-up messages for overdue invoices or deliverables. These tools not only help entrepreneurs stay on top of their obligations but also simplify collaboration with attorneys or accountants when needed, reducing the risk of disputes and ensuring smoother operations.

Conclusion

Key Takeaways

You don’t need to be a legal expert to navigate contract law effectively - it’s about understanding the basics and putting solid processes in place to protect your business. At its core, every binding contract needs clear terms, mutual agreement, consideration, and a lawful purpose. Using detailed written contracts helps prevent disputes before they arise. To safeguard your interests, include clauses like limitations of liability, dispute resolution methods (e.g., mediation or arbitration), termination rights, and notice provisions.

Keep thorough documentation to back up what was agreed upon and how each party fulfilled their obligations. Training your team - especially those in sales, project management, and finance - is crucial to ensure that promises made to customers align with the actual contract terms. If a breach occurs, act quickly: review the contract, determine if the breach is major or minor, calculate any losses, and notify the other party in writing. Many disputes can be resolved through negotiation or mediation, which saves time, money, and often preserves valuable business relationships. These steps lay the groundwork for stronger contract management over time.

Final Thoughts

Think of this guide as your starting point. Begin by focusing on one area at a time - whether it’s standardizing your contracts, improving documentation, or adding clear dispute resolution clauses. Gradual improvements like these can significantly lower the chances of a breach disrupting your business. And if issues do arise, you’ll be better equipped to handle them calmly and protect your cash flow.

For more complex contracts or high-stakes breaches - especially if you receive a demand letter or lawsuit - consult a licensed attorney in your state. They can help you evaluate the situation, preserve evidence, and guide you through negotiations or litigation. Keep in mind that most states require breach of written contract lawsuits to be filed within 3–6 years from the date of the breach, depending on the jurisdiction.

DashK12 offers business consulting, e-books, and CTE classroom resources to help you apply these principles - whether you’re refining your own contract practices or teaching the next generation of entrepreneurs how to manage risk and handle disputes. As your business grows, continue to refine your contract strategies to protect your operations and maintain steady cash flow.

FAQs

How can I protect my small business from a breach of contract?

To protect your small business from a breach of contract, start by drafting clear and detailed written agreements that spell out all terms and conditions. Make sure everyone involved understands their responsibilities by maintaining open and regular communication. Fulfill your obligations on time and keep organized records of transactions and correspondence for reference.

It’s also wise to review contracts periodically to ensure they stay relevant and comply with any changes in laws or business practices. If you’re uncertain about specific terms or potential risks, consult a legal expert to address concerns before they turn into problems. These steps can help prevent misunderstandings and safeguard your business relationships.

How can I tell if a breach of contract is significant or minor?

A major breach (often referred to as a material breach) happens when the violation is so serious that it disrupts the core intent of the agreement. This type of breach may give the non-breaching party the right to terminate the contract. On the other hand, a minor breach involves smaller infractions that don’t significantly impact the agreement’s overall purpose.

To figure out the nature of the breach, consider these key points:

- Does it affect the contract's main purpose? If the breach stops the agreement from achieving its primary goals, it’s likely a major issue.

- Are the promised benefits lost? If the non-breaching party is deprived of the main benefits outlined in the contract, the breach could be serious.

- How far does it stray from the terms? The degree to which the breach deviates from the agreed-upon terms can help determine its severity.

Evaluating these factors can guide your next steps, including deciding if legal action might be necessary.

What are the best ways to settle a contract dispute without going to court?

Settling a contract dispute without going to court can often be a smarter and less stressful choice. Here are some effective ways to handle it:

- Negotiation: This involves both sides sitting down and working together to reach a solution that satisfies everyone. It’s direct and can be the simplest option.

- Mediation: Here, a neutral third party steps in to guide the discussion and help both sides arrive at a resolution that works for them.

- Arbitration: In this case, an impartial third party listens to the details of the dispute and makes a decision that both parties agree to follow.

These approaches are usually faster, more private, and less costly than taking the matter to court, making them a practical choice for resolving disagreements.